Usually a current asset that reports the amount of rent that the landlord/owner has earned, but has not been received as of the date of the balance sheet. Deferred rent is one of the most commonly discussed items regarding the differences between ASC 840 and ASC 842. This article discusses the lease accounting treatment for deferred rent and how the changes in the lease guidance impacted its treatment. Any time a court orders a property to establish a rental escrow account to ensure compliance, the property owner must fulfill all the ordered obligations to the standards of the court that issued the order.

Sign & Make It Legal

The receipt should only be filled in after the funds are transferred to the landlord.It is recorded as income only when the rental service is completed, i.e. the rental period has lapsed. Rent Receipts provide proof of rent payment for the renter and a record of income for the landlord. Typically, a rental receipt will include information such as the amount paid, how payment was made, and the location of the property. Deferred rent is a liability created when the cash payments and straight-line rent expense for an operating lease under ASC 840 do not equal one another. The transition to ASC 842 eliminated the deferred rent account from the balance sheet, but ultimately did not impact net income. Under ASC 842 any differences between the expense recognized and the actual cash paid are recognized in the lease liability and ROU asset.

Rent Receivable Journal Entry

Lessees would simply record a debit to rent expense and a credit to cash, reflecting the expense for using the leased asset and the payment made within the same period. Most businesses that account for revenue and expenses in accordance with Generally Accepted Accounting Principles (GAAP) use an accrual basis of accounting. Accrual accounting employs two core principles for every account you maintain on the company’s books.

Definition of Rent Revenue

- It provides insights into the recognition and presentation of rent expense in financial statements, complete with an example at the end of the article to illustrate rent expense measurement.

- On April 1, you will post a debit entry to the rent receivable account for $800 and post a corresponding credit entry to the rental revenue account for the same amount.

- The excess expense recorded over the total cash paid has been accrued or deferred until the cash payments are larger than the expense recognized and the accumulated liability is depleted to zero.

- Recall that prepaid expenses are considered an asset because they provide future economic benefits to the company.If you make or receive rent payments, it is important to keep a record of the transaction using a Rent Receipt.

- The credit to the rent revenue account increases the revenue account, as the company has earned the rent payment.

At the end of the lease, the total cash paid and the total expense recognized were the same, and therefore the cumulative balance in the deferred rent account for each individual lease equalled zero. Failure to classify prepaids accurately on the balance sheet can lead to material misstatements of financial information and poor business decision-making. Revenue is what comes when the company sells their products or deliver their services. Revenue is the income of the business, thus resulting in increasing of assets and decreasing of liabilities. Cash revenues lead to an increase in the revenue and credit sales lead to a decrease in the liabilities as your customer commits to pay you after a specific period of time.

At the end of the month, debit $4,000 to rent receivable and credit $4,000 to rent income in your general ledger. Sometimes, the company may have and rent its available property for extra revenue, such as available office space, etc. Earning the rent will occur in the next month, which is the period to which the payment applies.

However, if the tenant has not paid the June rent as of June 30, the landlord will report Rent Receivable of $2,000 and the tenant will report Rent Payable of $2,000. It is still only reported on the income statement and calculated on a straight-line basis. The amount of is rent receivable an asset the rental fee is $15,000 which is for 3 months of rent starting from January 01, 2021, to March 31, 2021. Cash deposit received from the lessee also does not constitute rent income. They are liabilities since the amount is normally refundable at the end of the contract.

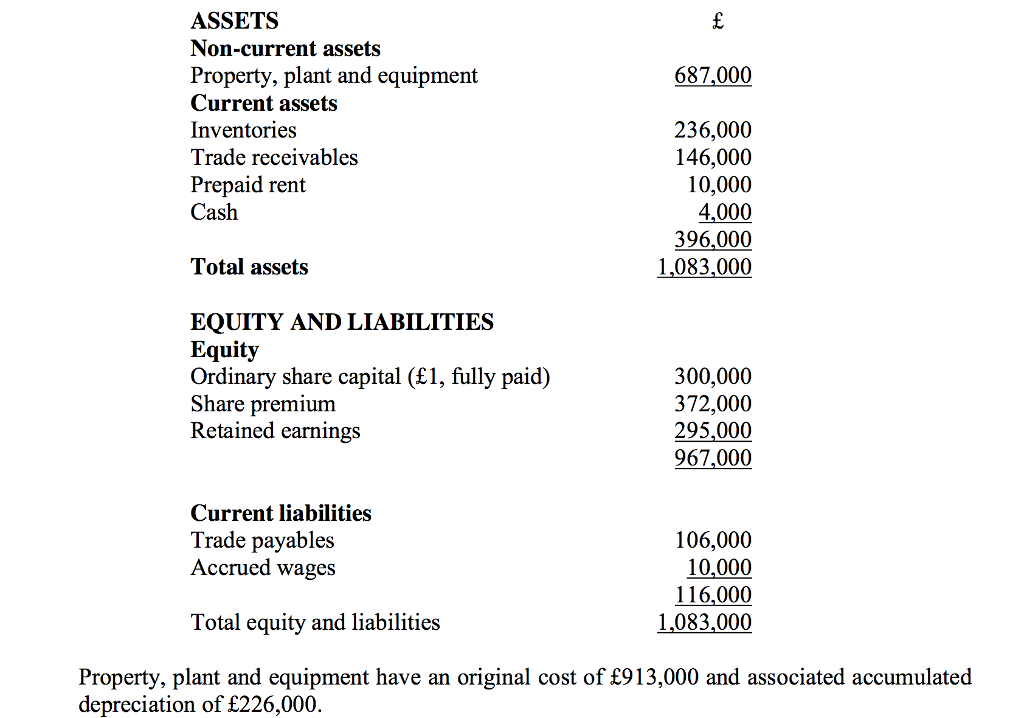

Along with recognizing the asset and liability, the lessee also pays $10,000 of IDC which is recorded as an increase to the ROU asset. Whether the prepaid is recorded as an asset or liability is dependent on the nature ofthe transaction. Under both ASC 840 and ASC 842, the formula to calculate straight-line rent expense is total net lease payments divided by the total number of periods in the lease. Example – On 20th December ABC Ltd received office rent from its tenant in cash 75,000 (25,000 x 3) for the next 3 months ie. Proper accounting of rent receivable and rent revenue is essential for accurate financial reporting.

Under ASC 840, a rent accrual liability was recorded in periods when rent was incurred, because the company used or occupied the leased asset and not yet made a payment. The entity received the economic benefit of the leased asset in the period and has an obligation to pay for the benefit it received. Per ASC 842, the ROU asset is equal to the lease liability calculated in step 3 above, adjusted by deferred or prepaid rent and lease incentives. In this example, it is the liability of $11,254,351 minus the incentive balance of $200,000. Rent Receivable is one of the highly liquid current assets against renting service provided.